The BC First-Time New Home Buyers' Bonus is a one-time bonus payment worth up to $10,000 for first-time

new home buyers in BC. Applicants can receive a cheque of up to $10,000, if they qualify, and the amount of the

bonus is not taxable. The legislation to enact the BC First-Time New Home Buyers' Bonus received Royal Assent

on May 31, 2012.

Eligibility Criteria

First-Time New Home Buyer Qualifications

- Eligible claimants must be first-time homebuyers - an individual who has never previously owned a primary residence anywhere in the world;

- For couples, neither the individual nor the spouse or common law partner can have previously owned a primary residence anywhere in the world;

- In the case of multiple buyers of a home, each buyer must be a first-time home buyer having never owned a primary residence anywhere in the world;

- The claimant must file a BC resident personal income tax return for 2011 or if the claimant moves to BC after December 31, 2011, must file a 2012 BC resident personal income tax return;

- Individuals or families who move to BC after December 31, 2012 will not be eligible.

Please note: in addition to the BC First-Time New Home Buyers' Bonus you may also be eligible for the Property

Transfer Tax First Time Home Buyers' Program. You can find more information on the Property Transfer Tax First

Time Home Buyers' Program here.

Eligible New Homes

Newly Constructed Homes and Substantially Renovated Homes

- The bonus is available in respect of new homes located in BC (i.e. newly constructed homes purchased from a builder and substantially renovated homes), on which HST is payable;

- A substantially renovated home is one where all or substantially all of the interior of a building has been removed or replaced, generally 90% or more of the home must be renovated to qualify;

- The written agreement of purchase and sale for the home must be entered into on or after February 21, 2012 and before April 1, 2013;

- Ownership or possession of the home must transfer before April 1, 2013;

- Eligible new homes include detached houses, semi-detached houses, duplexes, and townhouses, residential condominium units, mobile homes and floating homes and residential units in a cooperative housing corporation.

Eligible Owner-Built Homes

The bonus is available in respect of owner-built homes:

- Where the written agreement of purchase and sale for the land is entered into on or after February 21, 2012 and before April 1, 2013;

- The bonus will be based on land and construction costs subject to HST;

- Construction of the home must be complete, or the home must be occupied, before April 1, 2013.

- The claimant must be eligible for the BC HST New Housing Rebate in order to receive the bonus;

- The claimant must intend to live in the house as a primary residence;

- No one else has claimed the bonus in respect of the home.

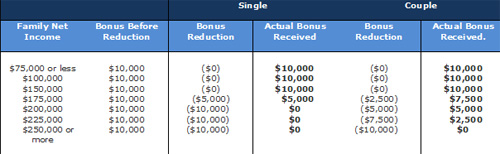

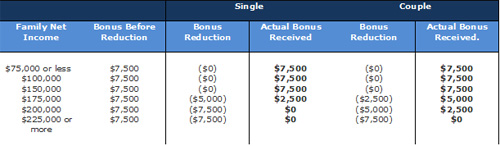

- The bonus is calculated as 5% of the purchase price (not including HST) of the home up to a maximum of $10,000;

- The bonus is income tested. For single individuals, the bonus will be phased out at a rate of 20 per cent of net income in excess of $150,000 and eliminated at incomes greater than $200,000. For couples, the bonus will be phased out at a rate of 10 per cent of family net income in excess of $150,000, and eliminated at family incomes greater than $250,000.

Home Price* - $200, 000 Or More

Home Price* - $150, 000

*In the case of owner-built homes, the bonus amount will be calculated based on the amount on the land and

construction costs that are subject to HST.

How to Apply

You must apply to the BC Ministry of Finance to receive the bonus. The ministry will process applications,

determine eligibility, and issue the bonus payments. The bonus is not claimed when filing an income tax return.

Information on the application process and the application form is available at the following link:

Comments:

Post Your Comment: